We Work With Companies You Can Trust

Top A-Rated Insurance Carriers

Compare prices among the nation’s most trusted insurers.

Get a Personalized Life Insurance Quote

Complete the short survey below to receive a personalized quote from Us.

What is Life Insurance?

Life insurance is a type of insurance policy that provides financial protection to the policyholder's loved ones in the event of the policyholder's death. The policy pays out a death benefit to the policy's beneficiaries, which can be used to cover expenses such as funeral costs, outstanding debts, or lost income.

There are several different types of life insurance, and each has its own features and benefits.

Term Life Insurance

Term life insurance provides coverage for a specific period of time, such as 10, 20, or 30 years. If the policyholder dies during the term of the policy, the policy pays out a death benefit to the policy's beneficiaries. Term life insurance is typically less expensive than other types of life insurance, but the death benefit is only paid out if the policyholder dies during the term of the policy.

Whole life insurance

Whole life insurance provides coverage for the policyholder's entire life, as long as the premiums are paid. In addition to the death benefit, whole life insurance also has a cash value component that accumulates over time and can be accessed by the policyholder while they are alive. Whole life insurance is typically more expensive than term life insurance, but the death benefit is guaranteed, and the policy has a cash value component.

Universal life insurance

Universal life insurance is a type of permanent life insurance that provides flexible coverage options and the ability to adjust the policy's premiums and death benefit. It also has a cash value component that accumulates over time, and the policyholder can access the cash value while they are alive. Universal life insurance is typically more expensive than whole life insurance, but it offers more flexibility and the ability to adjust the policy to meet the policyholder's changing needs.

Variable life insurance

Variable life insurance is a type of permanent life insurance that offers the potential for higher returns on the policy's cash value. The policyholder can choose to invest the cash value in a variety of investment options, such as stocks or mutual funds, and the returns on the investments can increase the policy's cash value and death benefit. However, the investments are subject to market fluctuations, and the policyholder's cash value and death benefit can decrease if the investments perform poorly. Variable life insurance is typically more expensive than universal life insurance, and it is only suitable for policyholders who are willing to take on the risks associated with investing the policy's cash value.

Top Five Life Insurance Myths

Don’t let these five misconceptions delay you from protecting your loved ones with life insurance. ...more

Life insurance

May 01, 2023•3 min read

Life Insurance Facts You Need to Know

Is coverage as expensive as people think? The numbers might surprise you. ...more

Life insurance

May 01, 2023•2 min read

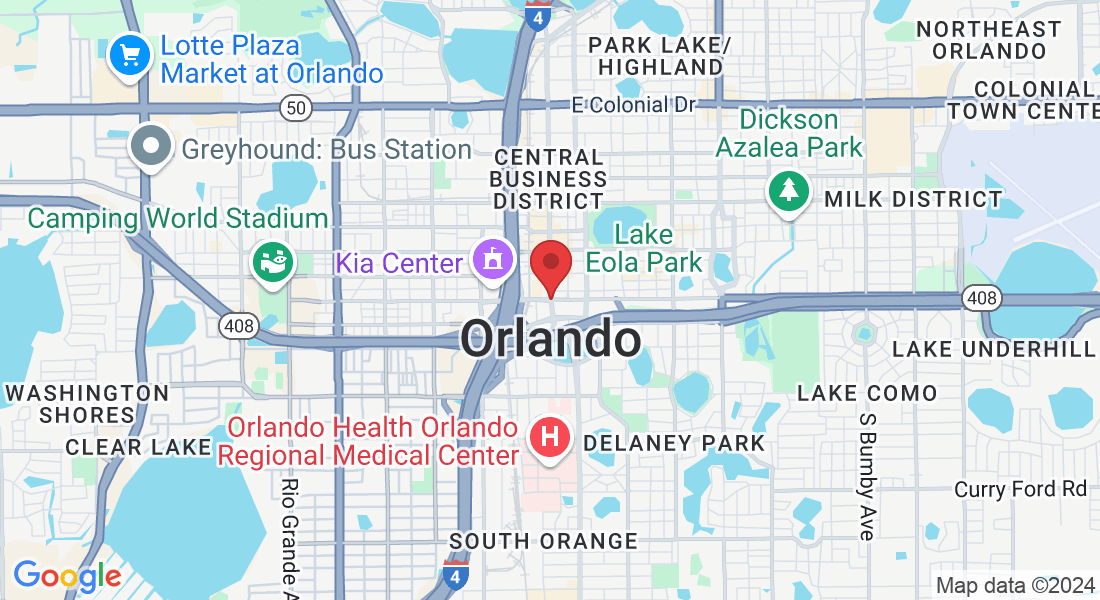

Contact Us

If you have any questions about the insurance process, please fill out this form and one of our experienced brokers will get back in touch with what's going on as quickly as possible.

Reviews

© 2023 Mendez Family Insurance - All Rights Reserved

Rudy Mendez LLC, Mendez family Insurance